Second half of 2023 closing: Data room trends, challenges, and a 2024 lookout

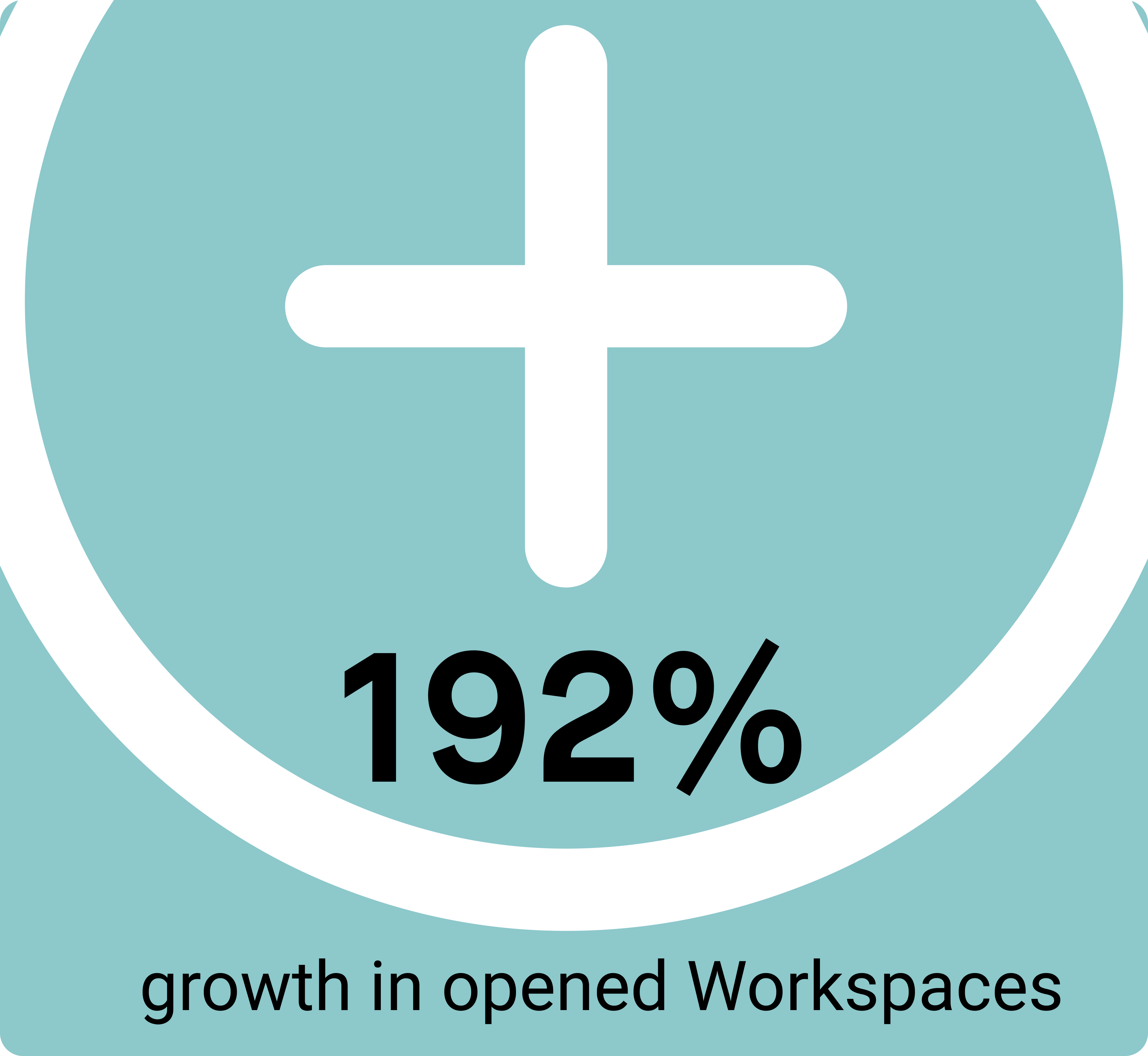

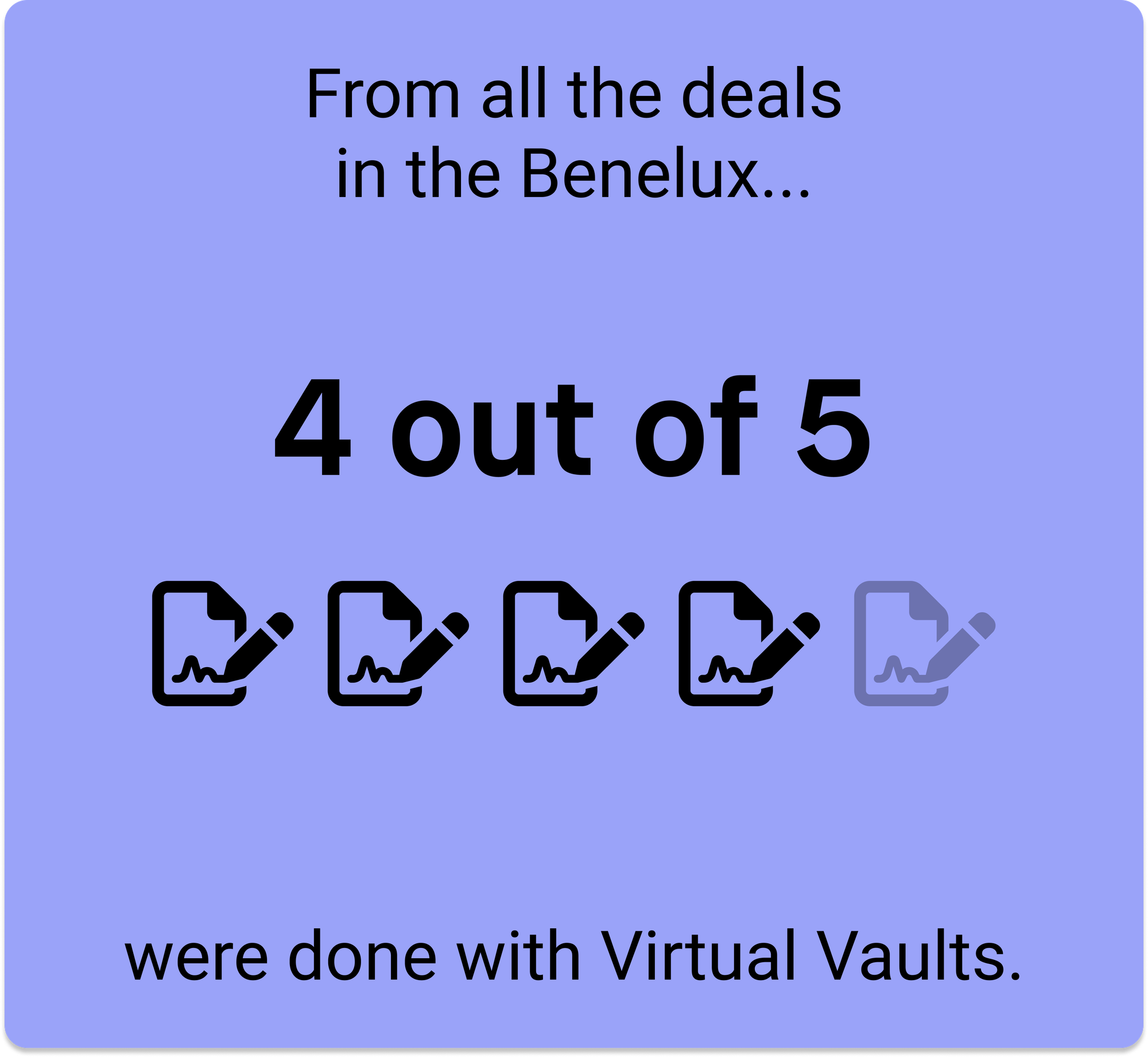

Virtual Vaults, the leading virtual data room provider in Europe, reports a substantial increase in VDR openings, with 80% of deals in the Benelux market. CEO Jeroen Kruithof anticipates a rise in 1H2024 deal volumes despite potential challenges. Troubled European companies attract investors, and the energy transition in the EU is expected to drive more deals. Noteworthy is a 192% growth in new Workspaces, contributing to effective deal preparations.

Virtual Vaults notes broader M&A trends, including European market recovery, evolving deal preparation strategies, and the growing influence of AI solutions like ChatGPT. The goal is to keep advisors informed about the changing dealmaking landscape, covering VDR volume, deal preparation significance, M&A challenges, emerging trends, and AI's potential impact in the legal sector.

How has the deal volume progressed through the second half of 2023?

In the second half of 2023, we have observed a significant increase in the number of VDRs being opened on our platform. Compared to the first half of the year, the growth rate of data rooms being opened in 2H23 is higher than 2H22, which is a positive trend. We had anticipated an increase in new data rooms due to our “Workspaces” pipeline, where deal preparation is done, but the actual numbers exceeded our expectations.

In our home market, the Benelux, 80% of all deals have gone through Virtual Vaults in 2H2023. We have also noticed a steady increase in opened VDRs in neighboring countries such as Germany, the UK, and the Nordics. Overall, there are 64% more active organizations on our platform in 2H2023 compared to last year.

What do you think deal volumes will be like in 2024?

We anticipate that deal volumes will increase next year, but the process will be more challenging. Banks will be more demanding on financing, which will require buyers to spend more time on due diligence. Sellers will need to be better prepared and take more time for Q&A. Therefore, we expect VDRs to remain open longer than the average of six months.

In Europe, we have observed a rise in troubled companies due to higher salaries, interest rates, and resource costs. This makes them, especially the SME companies, an easy target for investors. Additionally, we expect inflation to settle and interest rates to normalize, leading to a small growth in deal volumes in the first half of 2024 compared to 2023.

The growing importance of the energy transition in the EU and the associated investments will likely result in more deals being done in the energy sector. However, we do not expect real estate to recover anytime soon. Nonetheless, we anticipate a small growth for real estate transactions as investors will be de-risking.

Private equity is less dependent on banks for financing transactions. They still have a lot of capital available, so we expect to see a higher deal volume for 1H2024.

Recent trend in the market: Workspaces is rapidly growing

We have observed an interesting trend where more and more of our data room users are preparing their deals on our platform, leading to a more effective and higher quality preparation of their project. This year, we have experienced a 192% growth in new Workspaces being opened. The adoption rate for this product among our users has grown from 20% in 2022 to 50% in 2023, meaning every second data room on Virtual Vaults has first been prepared in Workspaces.